Wednesday, 28 September 2016

Tuesday, 27 September 2016

Monday, 26 September 2016

Sunday, 25 September 2016

S&P moving goalposts again, says Sinckler.

September 25, 2016

Economy

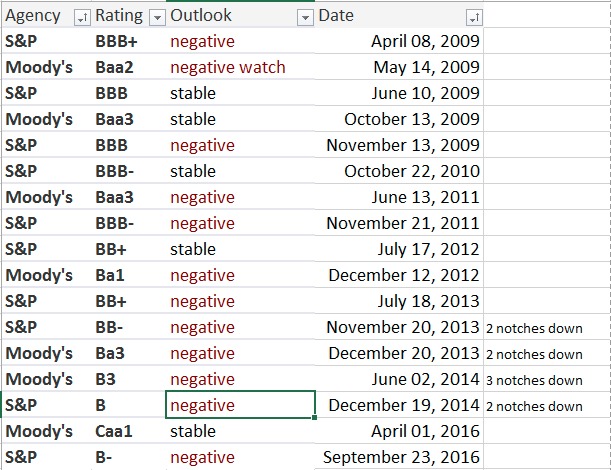

On Friday, Standard & Poor’s reduced Barbados sovereign credit rating down from B to B- and once again chided Prime Minister Freundel Stuart’s administration for its high fiscal deficit.

“It is unfortunate but not generally unexpected,” Sinckler told the SUNDAY SUN last night. “Once Moody’s took action earlier this year we expected Standard and Poor’s would have likely done similarly, though, of course, we had hoped they wouldn’t.

“It is pretty much the same premise as before. They (rating agencies) prefer to see a faster and deeper rate of deficit reduction, leading to a stabilisation of the debt variables and now seemingly a faster rate of growth.” (BA)

Saturday, 24 September 2016

Atlantic tropical disturbance east of the Windward Islands and Barbados.

September 24, 2016

General Info

Saturday 24th 5pm - Atlantic tropical disturbance east of the Windward Islands Barbados be ready for tropical storm conditions that will include wind gusts to 60 mph, flooding rainfall with totals of 2-5 inches and very rough seas with sea heights of up to 6-10 feet possible starting late Tuesday night and continuing through all day Wednesday and all night Wednesday night before weather conditions improve on Thursday morning.

Friday, 23 September 2016

Barbados has been downgraded yet again by Standard & Poor's Global

September 23, 2016

Economy, General Info

Thursday, 22 September 2016

Wednesday, 21 September 2016

Defining the foreign reserves

However, in his attempt to underscore the point, he made a rookie mistake which perhaps may be lost on some people but not to those who took the time to listen to him carefully.

However, in his attempt to underscore the point, he made a rookie mistake which perhaps may be lost on some people but not to those who took the time to listen to him carefully.

I must admit that it is indeed good news that it has only taken him six years to learn the definition of the net international reserves. For that, we must give thanks and praises. There may be hope yet but don’t hold your breath.

I quote directly from the Minister here. “Indeed, Sir, I believe that we have to be very wary of people who seem so hell bent on creating confusion in Barbados, especially on this issue of foreign reserves, that I understand their next false argument and scaremongering tactic is to suggest that by their calculations, Barbados is in a worst position concerning foreign reserves today than we were in 1991.”

“And how are we to imagine this unbelievable conclusion? By their ridiculous argumentation that the Central Bank of Barbados (CBB) is calculating foreign Sinking Fund Assets and Special Drawing Rights (SDRs) in the computation of the reserves and this should not be done because these are earmarked assets designated for specific purposes.”

He went on later to state: “The truth is, Sir, that from the very early days of foreign exchange reserves calculation, management and monitoring, authorities across the world, including here in Barbados, calculated Sinking Fund and SDR assets as part of the country’s international reserves. This is so because they are part of your reserves and it is also so because the country is free to, at any time it desires and sees the need to do so, draw down those resources to assist in the orderly management of its external payments.”

The minister failed to make connection with the fact that sinking funds referred to in the reserves definition cannot be used for any other purpose than to repay our external debt principal. Simply put, imagine you are part of a meeting turn, and the timing or maturity of your turn coincides with your household’s Back-to-School preparations.

As you are setting aside the little berry every week/fortnight/month, these sums can be regarded as part of your household’s total reserve (in much the same light as the country’s reserves) which will also include any other monies you have in a bank or credit union and any other cash, shares or securities in your possession. Indeed, these are your assets which are entirely at your disposal.

So, to apply Minister Sinckler’s logic, you the reader could decide to use your meeting turn to pay for a Kadooment costume instead of its original purpose – namely, financing your Back-to-School preparations — and expect that your children, grandchildren and/or nieces and nephews would have an orderly transition back to school.

However, it became quite clear to me thereafter that his demonstration of learning was a clear case of regurgitation of perhaps a Google search performed that afternoon and not a fundamental understanding of the said definition. I came to this conclusion because he went on to further state that “There are no conditions at present that would lead us to conclude that we need to reverse that stance. Equally, there is nothing in the current or medium to longer term trends to even remotely suggest that any adjustment to the official exchange rate in Barbados is required.”

The Minister’s statement was clearly at odds with that of the Governor of the Central Bank in his June 2016 press release that measures needed to be taken to restrict foreign exchange outflows. I can think of nothing else that could create more confusion in foreign exchange markets than when there is public disagreement between policymakers, who have both expressed the view that Barbados has to monitor its foreign exchange levels on a daily basis.

If we were to apply the same principle to our individual health, the only time we as individuals would need to be monitored by a doctor on a daily basis would be if we were in intensive care. We all know there is a difference between routine visits, being admitted to the general ward versus being on intensive care. This brings me to the Central Bank and its printing on money along with observations by the IMF.

In its February 2013 statement at the conclusion of the IMF Article IV consultation mission, the following was stated: “Under a new interest rate policy framework in place since April, the Central Bank of Barbados (CBB) has increased its holdings of Treasury bills in 2013, resulting in a decline in short-term yields. Direct financing of the government, which is exacerbating pressures on the balance of payments, should be reversed and short-term interest rates allowed to rise to levels more consistent with safeguarding the exchange rate anchor. This would demonstrate that monetary policy is supportive of the currency peg.”

In February 2014, the IMF Executive Board noted “Directors noted the authorities’ commitment to the nominal exchange rate anchor. They encouraged the central bank to reorient monetary policy towards supporting the exchange rate peg by curtailing direct financing of the government, and allowing domestic short-term interest rates to rise to a level that reflects a credible country risk premium.”

Before I become a candidate for the Barbados Labour Party in 2015, I was invited to provide an analysis of the 2013 IMF Article IV Consultation in February 2014 (https://www.youtube.com/watch?v=Ri6OfYP9Xqk). I was able to highlight for those who attended the state of the economy and the consequence that printing money would have on the economic fortunes in Barbados.

Since then, the Minister of Finance, acting on behalf of the Government of Barbados, has refused to publicly release any further IMF Article IV-related Staff Reports presumably because he fears me having a conversation with Barbadians about exactly what it is store. I think it is quite petty because markets require information upon which to base their decisions, and without it, rumour and innuendo will fill the void.

Fundamentally, the issue isn’t only the release of the information but a complete change in the both the monetary and fiscal policies being pursued by the Central Bank of Barbados and the Ministry of Finance.

(Ryan Straughn is a UWI Cave Hill and Central Bank of Barbados-trained economist. He is an endorsed BLP candidate to contest the next general election.

Email: straughn.ryan@gmail.com)

Email: straughn.ryan@gmail.com)

Tuesday, 20 September 2016

Repairs still pending - The pavilion at Wotton since January 2016

September 20, 2016

Constituency

Lashley’s comments during a tour after a two-part series in the SUNDAY SUN editions of January 10 and 16 highlighted the deteriorating condition of the facilities. Last Thursday, SUNSPORT team revisited the sporting facilities highlighted in the January 10 edition, to determine what work and improvements had been done. While they were impressed by the refurbishment of the hard courts at Holder’s Hill, St James, the same could not be said about the other four venues. Little to no work has been done at these facilities.

Monday, 19 September 2016

Explain Cheques (by nationnews)

YOU THINK THAT BECAUSE I write once or twice about the Central Bank, that I would believe everything I hear about it? This old lady met me in the fish market while I was looking for a small dolphin to help with my diabetes.

“Wild Coot,” she said, “is the Central Bank supposed to be making payments on behalf of the Ministry of Sport and Culture, or am I giving my mouth liberty?” I know that the Central Bank is entitled to issue cheques in order to conduct its own business and maybe its business coincided with the business of the Ministry of Sports and Culture. However, what a strange coincidence. How come the business of the Central Bank and that of the ministry coalesce? One has to question apparently innocent happenings these days, as everything seems to be taking a turn for the worse. If the Central Bank is paying bills on behalf of the ministry, then that may be tantamount to printing money. It would be giving further credence to the feelings that the Government’s policies are not working and that the income of Government is seriously deficient as opposed to the immediate demands for expenditure.

Let us look at how the Central Bank earns money. If it has US dollars it can place them on an interest-bearing account in the United States at a small interest rate. If it pays 7.5 per cent in order to attract bonds from savers and lends this money to the Government, the poor Government cannot match this rate and hence that money is placed at a loss. In all likelihood, the compulsory deposits (at least 10-15 per cent of all deposits) of the commercial banks have already been given to the Government. Commercial banks and others that buy treasury bills which support Government’s shortfalls have to be paid. Then the Central Bank has to pay salaries to the governor and staff. Monthly there are utility bills, entertainment and trips abroad.

A couple of years ago the Central Bank confessed that it had made a huge loss. I am sure that the loss continues. That means that its income cannot sustain its expenditure.

“Are you saying Wild Coot that if the Central Bank is issuing cheques, then it has to print the money to honour them?”

The accusation of the old lady had me worried, as she must have got her information from somewhere. The saying is that where there is smoke, look out for fire. Look how the Central Bank has played a pivotal role in ensuring that the savings of the people end up in the hands of Government – unsecured, while the commercial banks and quasi banks fight for the financing of vehicles, overseas shopping with credit cards and 4.5 per cent mortgages for two years.

I agree with my friend Sir Frank Alleyne that any consideration of changing the parity of the Barbados dollar is not an option of any right-thinking Barbadian. If that were to happen, Mr Lewis would have an even stronger case for structure much to the disapproval of Mr Shepherd. We have ample evidence of that devaluation pitfall. Worse so, we do not have the internal mechanism to counter such a move. Sir Frank emphasised that the middle class would be destroyed. You can imagine what would happen to the poor. It is said that during the war, we were forced to feed ourselves but that was in 1939-1944.

I am only thinking about these things because the old lady frightened me with her revelations. Surely the relationship between the printing of money and the negative impact on the foreign reserves has sunken in with the Central Bank. Did not Mr Arthur say so? Now no less a person, Sir Frank, is saying so. The Wild Coot said so a long time ago. He came face to face with it in Jamaica.

The Central Bank should publish one of its rare statements giving a lie to this malicious, stinking fabrication since as the watchdog of the people, it cannot offer as an excuse that its hands are tied.

“Wild Coot, what I tell you is the gospel,” said the old lady. “You could even ask your friend from over and away.” I replied that I would seek out the information. I am sure that the Central Bank is attending to the “busyness” of seeing that the commercial banks walk the straight and narrow.

• Harry Russell is a banker. Email: quijote70@gmail.com

Sunday, 18 September 2016

Inniss wants clear-cut levy (by nationnews)

During a sometimes contentious meeting between manufacturers and officials of the Barbados Revenue Authority (BRA) yesterday in the Barbados Investment & Development Corporation (BIDC) offices on Harbour Road, St Michael, Inniss pledged to sit down with Minister of Finance Chris Sinckler to “go back to the drawing table” and iron out any discrepancies.

“I was part of the team that would have passed the Budgetary Proposals in August. The challenge right now is implementing [the levy] and listening to you here and to others. There is quite a bit of confusion and where there is confusion, we have a duty to find a solution.” (CA)

Businesses need clarity now on Social Responsibility Levy - article from loopnews

Saturday, 17 September 2016

'It is like 1991 all over again' (by BarbadosToday)

In resolutions yet to be debated in Parliament, Government has proposed a ten per cent hike in pay for all Cabinet members, Members of Parliament, Parliamentary Secretaries, and Senators.

Meantime, Sinckler announced in the 2016 Financial Statement and Budgetary Proposals that a two per cent National Social Responsibility Levy would be imposed on imports effective September 1.

The Minister of Finance estimated that Government would raise $142.1 million in additional revenue from the measure.

Addressing a Barbados Labour Party (BLP) meeting in St Michael West on Sunday, Straughn said this situation was eerily similar to what happened 25 years ago.

“You just increased everybody’s cost of living by two per cent since introduction of the National Social Responsibility Levy, but these fellows intend to increase their salaries by ten per cent,” the BLP Christ Church East Central candidate told party supporters.

“This sounds familiar because in the early 1990s they increased their salary by ten per cent and then cut everybody else’s own by eight, and now in 2016 they are increasing theirs by ten and then taking two per cent of out of everybody else’s pocket. So, in effect, they’re eight per cent better off than everybody else.

“What is it about the Democratic Labour Party that eight per cent seems to be a recurring theme?” he queried.

Straughn, who just two days before the budget presentation had predicted Barbadians would be burdened with more than $120 million in additional taxes, said the heavy tax burden imposed during the current Democratic Labour Party administration had not helped to turn the economic or social situation around.

“After all of this money that each of us line up and pay, year after year, there isn’t a public service in Barbados right now that you can say with confidence is working,” he contended.

The Opposition candidate described the budget as a theatrical play without any specific, substantive measures that Barbadians could “take to the bank, have some faith in, or can articulate that would truly make our lives just a little better”.

“When you tax citizens, you have to deliver something tangible that is of benefit, not just today, but going forward, and I am not seeing that happening right now . . . There is nothing tangible that we could say is going to take us into the next 50 years with confidence. There is nothing that we can point to in Barbados that we can say is working,” Straughn added.